Picture this: it’s a regular Tuesday afternoon when your client calls with a quick update. They’ve just closed a major funding round and want to announce it ASAP.

For tech PR agencies and B2B communications teams, moments like this can spark both excitement and a mild sense of panic. Funding announcements are often the biggest milestones in a company’s story — a public validation of growth, investor confidence, and market traction. News on funding can open doors to new prospects, attract top talent, and even attract investors for a subsequent round of funding.

But with so much at stake, a poorly planned rollout can easily fizzle. Timing missteps, unclear messaging, or last-minute scrambles for details can all take the shine off what should be a defining moment.

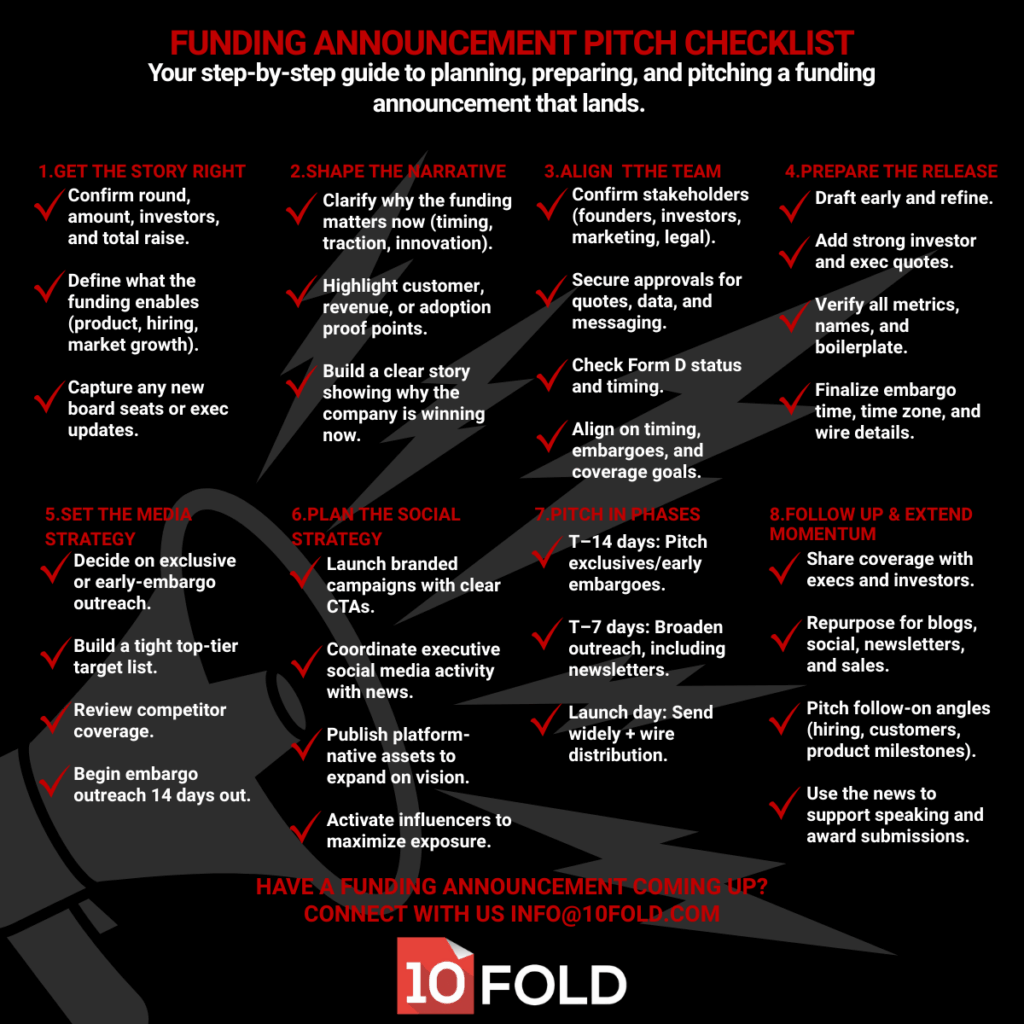

That’s why preparation matters just as much as the pitch. A successful funding announcement doesn’t start with the press release. It starts with the process that happens behind the scenes: gathering the right information, aligning expectations about what will be needed from the client, investors and / or customers (and when!), and setting up a pitch strategy that maximizes visibility without overpromising outcomes.

Here’s how to get your team and your client ready for a smooth, well-executed funding moment.

Build a Funding Narrative Business Press Reporters Will Care About

Before you can even think about outreach, take time to build a clear, compelling story. Funding on its own isn’t newsworthy, but why it’s happening now is. The goal is to uncover what this raise says about the company’s momentum, its market opportunity, and its credibility with investors.

DEFINING THE WHY: What problem is the company solving? What makes its approach different? How will the funding accelerate that vision? The clearer you are about the “why,” the easier it is to make reporters care.

At 10Fold, we often start by guiding clients through a deep-dive discovery session that surfaces everything from growth metrics and investor rationale to leadership changes and expansion goals. Those insights become the foundation of a story that goes beyond dollars and one that positions the company as a rising player in its space.

That’s where partnering with an experienced B2B public relations agency can make the difference between a basic announcement and a market-moving moment.

Set Clear Media Expectations for Funding Coverage

It’s critical to level-set with the client about what kind of coverage to expect. Unless the raise is over $75 million, most business press outlets won’t dedicate a full standalone article. That doesn’t mean the news won’t get attention. It just means it needs to be positioned carefully.

Business press also has a much higher bar for funding news. Outlets like The Wall Street Journal or Bloomberg rarely cover early-stage rounds unless there’s a strong trend angle or a major funding total attached. And when they do, much of that coverage sits behind a paywall, which can limit visibility more than clients expect.

We recommend comparing the client’s raise with:

- Competitors’ recent funding announcements

- Similar-stage or same-series rounds (A, B, C, etc.)

- Coverage patterns at target outlets

With clear expectations set, everyone understands the likely coverage path, whether it’s a feature story, inclusion in a funding roundup, or the foundation for longer-term thought leadership. Alignment at this stage helps prevent surprises and ensures the entire team is working toward the same outcome.

Build the Right Media List

Before thinking about exclusives, start by building a smart, strategic media target list. Not every reporter who covers your company’s product news, breaches, or industry trends will cover funding. Many funding stories live with business reporters, VC newsletters, or specific startup-focused beats. Understanding who actually cares about funding news is key.

A strong target list usually includes:

- Reporters who covered previous rounds and already know the company’s story.

- Top-tier business or startup reporters who regularly write about venture funding and market momentum.

- Relevant trade or vertical outlets that follow the company’s category or customer base.

- Local press in the company’s headquarters region that reliably cover funding and amplify regional credibility.

Some of these reporters may need an early jump, which is where an early embargo lift can be useful. It gives a trusted reporter a head start while keeping your broader media opportunity intact and flexible. Don’t forget about nontraditional outlets too, like podcasters who cover startup growth or LinkedIn creators who regularly spotlight fundraising news. These voices often have niche but influential followings that can extend the reach of your announcement.

The goal is to approach the outlets most likely to care, in the order that maximizes visibility without wasting time pitching reporters who don’t cover funding at all.

Time Your Pitching Right

Timing can make or break your coverage. Here’s a general cadence that works well:

- Two weeks before the announcement: Begin pitching your exclusive and early embargo lifts. This gives reporters time to schedule interviews and write.

- One week before the announcement: Expand embargo outreach to your full media list.

- Day of announcement: Send the release to anyone who didn’t get it under embargo.

One critical detail to align on early is Form D filing. Once a company submits a Form D to the SEC, the funding details become public, and reporters, newsletters, and data scrapers often surface it before you’ve begun outreach. Make sure you know exactly when Form D will be filed so your announcement doesn’t get scooped before you’re ready to go live.

A few details to keep in mind: Reporters’ inboxes are overflowing with startup updates, so early outreach is essential. Always confirm embargo times and include time zones to avoid confusion, especially when coordinating across multiple lists. Clear communication goes a long way toward building credibility and ensuring a smooth launch.

Prepare Spokespeople for Limited but High-Impact Funding Interviews

Once pitching begins, spokespeople need to be prepared for interview requests that can come in fast. Funding interviews often dig into specifics like growth metrics, competitive landscape, and why the raise is happening now. That means spokesperson alignment is just as critical as the pitch.

Use this phase to:

- Review the approved narrative and key talking points

- Align on which metrics can be publicly shared

- Flag any off-limits details (valuation, customers, financials)

- Prep answers to common funding questions

- Ensure consistency across all spokespeople

A well-prepared spokesperson can turn a straightforward funding announcement into a broader narrative moment and avoid missteps that complicate coverage. Since many funding stories are written straight from the release or pitch, spokespeople should be prepped for a limited number of interviews and ready to make the most of them.

Don’t Overlook VC and Business Funding Newsletters

Even if you don’t land a full article, there’s value in targeting VC and funding newsletters at top business outlets like Fortune, Wall Street Journal, and Axios Pro Rata. These reporters often include funding rounds in roundup columns that reach highly engaged investor audiences.

You can pitch these contacts closer to launch (about a week out), since their deadlines are typically more flexible. Keep the note short, emphasize investor names and funding amount, and include one or two crisp sentences that mirror how funding rounds are typically featured in the newsletter. The closer your pitch matches the format reporters already use, the easier it is for editors to plug your news into their roundup.

Extend Momentum Beyond the Funding Announcement

Once the funding news is live, the work isn’t done — it’s just beginning. One of the biggest mistakes companies make is treating a funding round as a one-and-done moment. Reporters notice when a company only shows up for a financing event.