The market for venture capital funding remains tight. According to EY, VC investment dropped 34% from Q1 to Q2 2023, down to $29.4 billion. If companies aren’t generating new equity investment – how are they maintaining cash flow? In this installment, I will review the growth of venture “debt” financing, PR strategy implications, and how reporters have responded to this wave of non-traditional announcements. If you have a debt round, should you disclose that? Will the market think your business is in trouble? Read on.

Business Implications

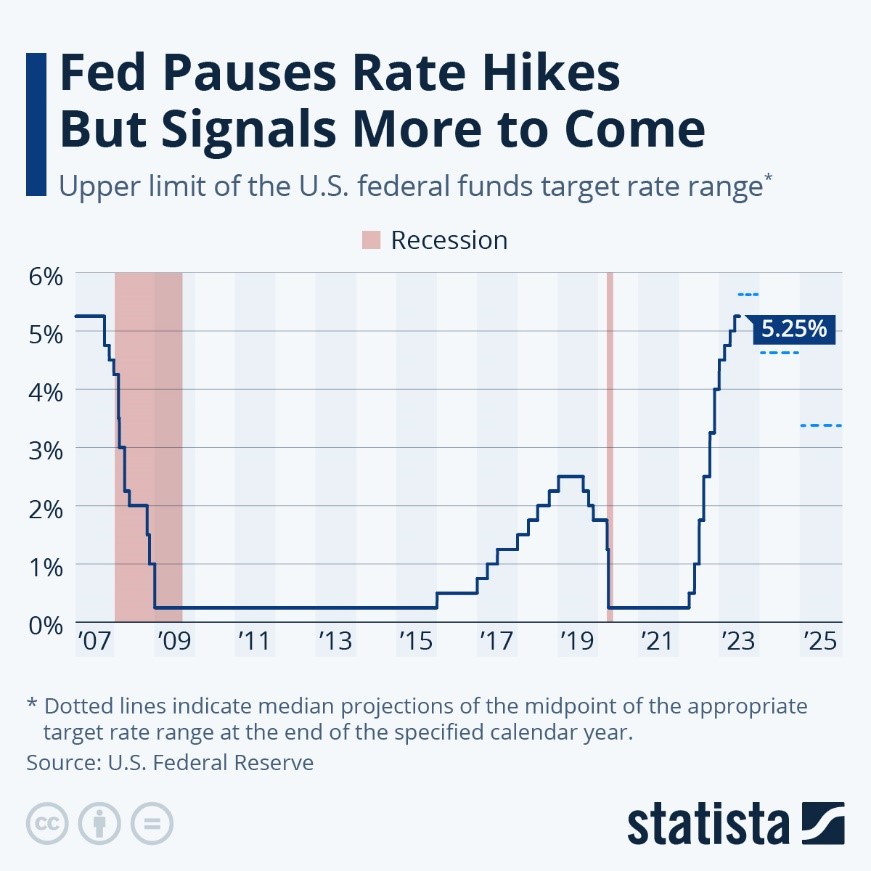

Skyrocketing interest rates and the collapse of Silicon Valley Bank contributed to an already conservative outlook from venture capitalists on investing in startups over the last two years. Cash is more expensive today than any time after the ’07-’08 recession. That said, for many startups, debt financing may be the only viable option to support continued operations, despite high interest rates, as equity investment opportunities prove increasingly difficult to capture.

What is venture debt? Unlike a traditional business loan, which would require the company to put up assets like real estate, equipment or inventory as security, in the tech sector, debt rounds are secured most often via intangible assets. TechCrunch’s Haje Jan Kamps describes this well: those who deliver venture debt financing are hedging against “your predictable revenue, your IP, and future VC backing.” The loan is expected to be repaid in cash, not equity.

The fact that debt financing does not include dilution of equity can be attractive to companies whose cap tables may be complicated or who do not wish to bring more players to the table. This has made it a financing instrument that was traditionally used in the later stages of a company’s development – when they had predictable revenue and had already taken on several rounds of funding. The difference today is that earlier-stage companies are also considering venture debt as a way to get past the Series A hump, where we see funding opportunities dry up.

Pitchbook’s quarterly analysis of startup investment reports that, over the last decade, venture debt has exploded: from $8.1 billion in 2013 to $33.5 billion in 2022. While it’s become more common as part of startup financing strategy, venture debt comes at a high cost – terms can be punishing, with high interest rates and relatively short runways to pay off the loan (within 2-5 years). In some cases, lenders are adding terms that could mean the loan can be called in at any time. If a company takes on this type of debt before it is confident in its product-market fit, it could spell disaster. A more mature company, or one with a strong path to revenue growth, will see it as a viable option to retain equity while getting needed capital to scale operations.

PR Strategy Considerations

Venture debt is often pursued “before the company needs it” and can follow on the heels of a more traditional equity round. Y Combinator and Flow Capital are two institutions that coach founders to pursue debt financing close on the heels of an equity round. What other factors should play into PR strategies?

- Valuation: Venture debt does use the valuation of the company based on investment during other rounds when determining the amount of the loan. Pursuing a debt round doesn’t typically indicate valuation has declined, but reporters always ask about this, so be prepared with a response, even if you don’t want to disclose it at all. As covered in the last blog on the “down” round, not disclosing valuation can be a strong strategy given how much valuation has dropped industry-wide among tech startups.

- Equity strategy: Depending on the stage of your startup, you may consider playing up the fact that debt rounds do not dilute equity. If your organization is in a C or D round (or beyond), the debt approach will not raise many eyebrows. However, if your organization is in an early stage, you may want to include growth metrics to demonstrate that this is not a last-ditch effort to continue cash flow, but a strategic decision to maintain control of the business. I also see many companies announce a combined round of both debt and equity. I’ll describe how this plays out in the media coverage analysis below.

- Business metrics: Play up the metrics that showed your organization as a good bet: ARR, customer retention, headcount growth, new customers, etc. Is this financing supporting a bid to scale in a specific area, perhaps expand to a different geo or invest in go-to-market capability? These elements will give reporters an indication that growth is occurring and why your organization is a good financial bet.

Media Coverage

Reporters have been covering the venture capital crunch for more than a year at this point. This certainly plays in your favor if you’re facing a debt round in the near future. Below I highlight recent cases of companies announcing debt rounds and how the media responded in their coverage.

Note: These are not 10Fold clients and were chosen purely at random.

Karat Financial: Karat represents a case of an earlier stage firm leveraging both traditional equity rounds alongside debt financing. Its most recent Series B round totaled $70M, with $40M in equity investment and $30M in debt financing. This isn’t first time Karat has used debt financing as part of its strategy: it also included $15M debt during its Series A. That must have gone well to take another dip into the debt bucket.

Overall, media coverage around the round in July was positive – reporters didn’t blink at the debt financing element of the news and The Information even highlighted that raising any equity funding “bucked” the trend. Karat Financial execs disclosed a “five-fold” customer growth metric since the Series A round and an estimated $250B total addressable market (TAM), though did not comment on valuation or revenues. By withholding some of these growth metrics, the media doesn’t have a lot to speculate about.

ALSO READ: When Investors Get Tough – Is ‘Down’ the New Flat?

For TechCrunch, one of Karat Financial’s founders addressed the use of debt financing directly: “Debt financing allows Karat to access working capital and cover cardholder spend while maintain control and flexibility, while the equity round led by SignalFire and the participation of esteemed investors brings not only financial resources but also valuable insights and networks to support the company’s trajectory.”

Coverage:

- TechCrunch: Karat, a startup building financial tools for content creators, raises $70M

- The Information: Card Startup Karat Raise $70 Million, Bucking Funding Trend

CoreWeave: Founded in 2018, CoreWeave announced a notable $2.3B in debt financing to support its scaling of its high-performing compute capacity – i.e. capital expenditure on hardware. In its press release, Coreweave refers back to the mega-rounds of equity funding it secured in April 2023: $221M in Series B and then a month later, an additional $200M in extension. Also noted was the $1.6B planned CoreWeave data center announced for Plano, TX.

Three things played in CoreWeave’s favor for coverage of this large debt financing. First, the recent equity round sets a bar and shows confidence for CoreWeave’s business. Second, throughout the coverage of this news, reporters highlight how CoreWeave’s offerings are positioned to take off due to the fast adoption generative AI and the compute requirements associated with that. This is backed by the disclosure of key business growth metrics, including the $500M revenue booked for 2023 and nearly $2B already contracted for 2024. Third, CoreWeave points to the significant capital expenditures (facilities, compute hardware) needed to scale its business.

Coverage:

- Reuters: CoreWeave raises $2.3 billion in debt collateralized by Nvidia chips

- VentureBeat: CoreWeave secures $2.3 billion in new financing for GPU cloud, data centers

Debt is no longer suspected to signal a floundering technology brand, even at early stages. That said, without strong growth metrics and if raised out of cycle with an equity round, reporters will catch on that the company is not “fundable” in a strict economic environment. Sequencing equity and debt financing announcements can draw a clear picture of growth without causing concern. But for founders who seek debt financing without a clear path to strong revenue growth, it could be a bad bet that spins them out of business.

Next up, the final chapter in our series: bridge loans and the path to IPO.