Unicorns Welcome! Others Need Not Apply . . .

Our latest guest blog from Mike Avila, Senior Advisor at SoHo Capital, provides insights into trends in the U.S. tech IPO market.

A surge in SPACs; the broad shift into technology by private equity; the impressive growth in

trading of private company shares on platforms like Forge Global and SharesPost: these trends

have been well documented. However, there has been little mention of one underlying factor

that has contributed to all of them – the incredibly high bar for a technology company to go

public in the U.S. today. With a surprisingly low number of venture-backed technology IPOs in

recent years, we have seen a dramatic growth in other options for much-needed liquidity.

Over the last few years, the U.S. financial markets have been characterized by a number of

favorable trends:

- record bull market;

- a market receptive to emerging growth IPOs;

- high valuations across many sectors of technology;

- and record levels of venture capital investment.

In March of 2020, the COVID-19 pandemic ended an 11-year bull market – the longest bull

market in U.S. history. That decline now looks much more like an anomalous blip rather than

the end of the bull market. Despite the pandemic, the Dow Jones Industrial Average and the

S&P 500 both closed at record highs in 2020, up 7.2% and 16.3% respectively over 2019. The

IPO window has also been wide open for years, hitting a high in 2020 driven in a large part by

SPACs. Valuations in many sectors of tech are at nosebleed levels. A few years ago, a valuation

of 15 times revenue for a SaaS company was considered spectacular. Today that would be

considered modest, with companies like Unity and Snowflake trading at over 50 times revenue.

In addition, VC investment is also at record levels, exceeding $100 billion in each of the last 3

years. According to the NVCA, a record $150 billion poured into U.S. startups in 2020.

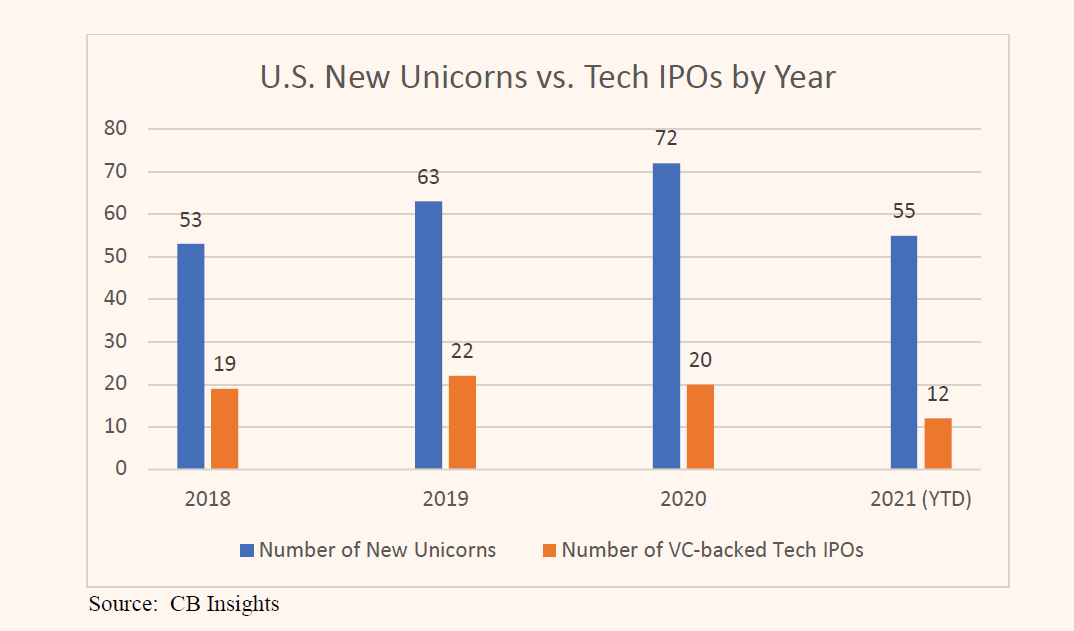

Despite all these positive data points, the number of venture-backed technology IPOs is

astonishingly low. In each of the last 4 years, there have been fewer than 25 venture-backed

U.S. tech IPOs. While no one expects to see the 200+ IPOs we saw in the dot-com bubble, 50-

100 tech IPOs per year in this environment seems a reasonable expectation.

The widespread availability of private capital, trends towards larger rounds of funding, and a

desire to stay private longer are just some of the factors resulting in fewer IPOs. This has also

fueled growth in the number of unicorns – private companies valued at $1 billion or

more. According to CB Insights, as of March 2021, there are over 600 unicorns worldwide,

approximately half of which are in the United States. Over the last several years, there have

been more new unicorns created in the U.S. than venture-backed technology IPOs.

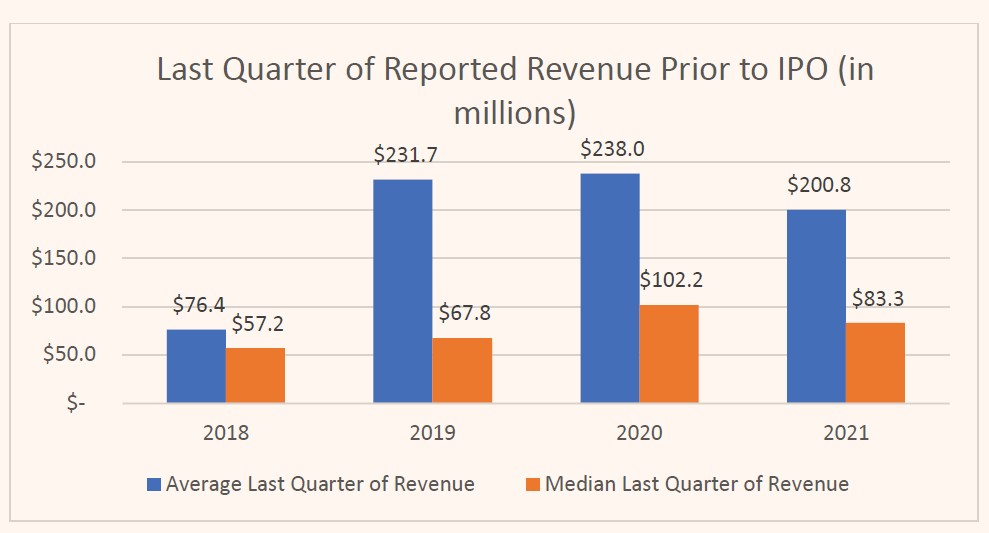

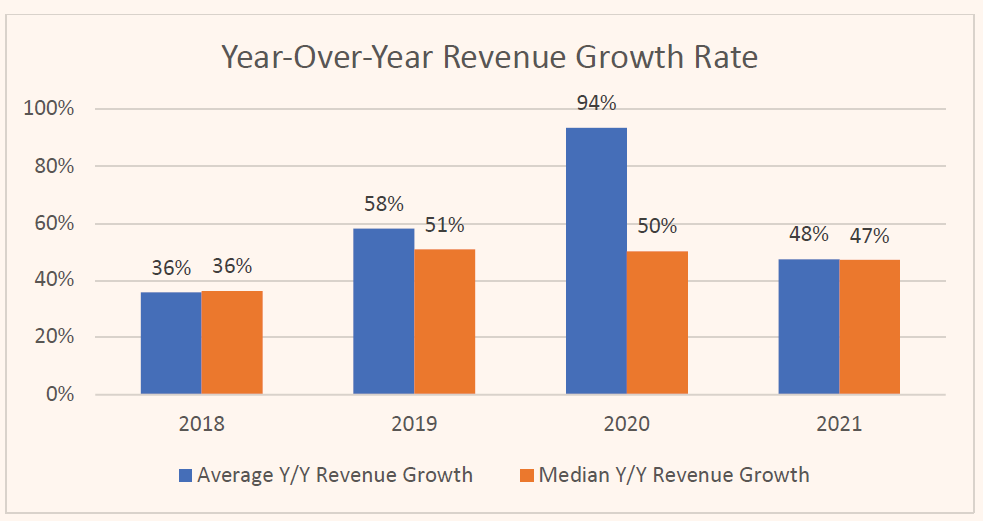

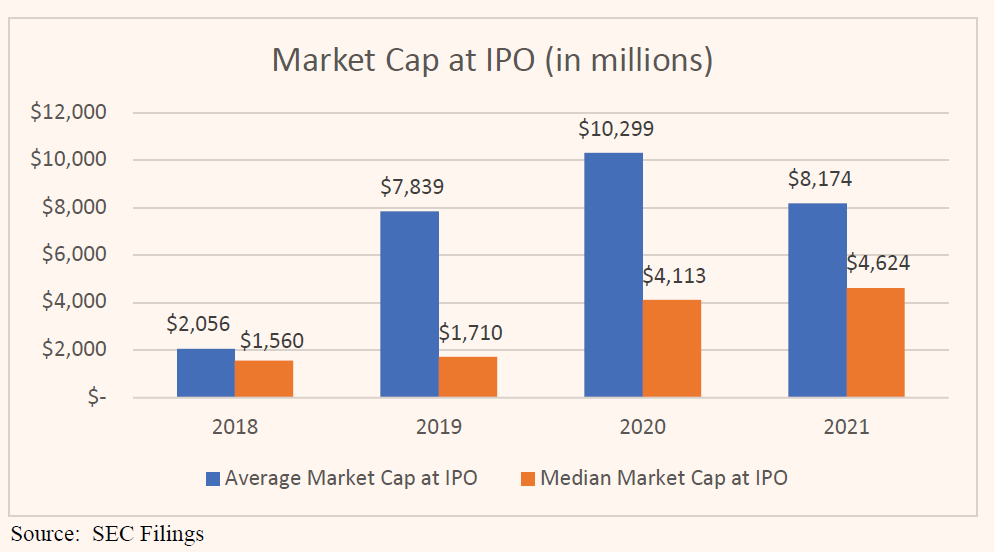

The bar to go public has become incredibly high. As a result, the IPO market has become a

playing field dominated by unicorns and hyper-growth companies. In 2018, of the 19 U.S.

companies that went public with a market cap of at least $100 million, only four had valuations

under $1 billion. Since the start of 2020, every single VC-backed tech IPO has had a market cap

of at least $1 billion. The metrics for these companies are truly astounding. The average last

reported quarter of revenue prior to IPO has grown from $76 million in 2018 to $201 million

today. The average year-over-year revenue growth rate has grown from 36% to approximately

50%. The average market cap at IPO in 2018 was $2.1 billion; in 2021 year-to-date it is $8.2

billion. That will likely climb to over $10 billion when Coinbase goes public later this

week. (Note: The following charts show medians as well as averages to account for outlier

effects on some averages – notably Uber in 2019 and Airbnb in 2020.)

Many bankers and VCs feel that the small IPO will probably never return. In the early 2000s, a

$50 million raise for a company with a $300 million market cap was a fairly typical IPO. Today

that is a Series B round. When Fortinet went public in 2009, it was one of the largest and highest

profile IPOs at the time. Led by proven entrepreneurs and a well-known CFO, the IPO had

dozens of investment banks competing for roles at a time when having 8 underwriters on the

prospectus cover was rare. The deal was upsized and priced above the initial filing range, raising

approximately $156 million in a very successful IPO. With an IPO valuation of $805 million,

this would have been one the smallest IPOs today, and some may argue that it might not even get

public.

With over 18,000 venture-backed companies in the U.S., there are concerns that the pace of VC

investment vastly exceeds liquidity events, creating a large overhang that will eventually need to

be resolved. Over $150 billion of venture capital inflow is being supported by only 20-30 IPOs

per year in some of the best market conditions. What happens when the market turns? What are

the options for the thousands of venture-backed companies 8-10 years after raising VC money

that are still not unicorns and are not growing at least 35-40% per year?

Against this backdrop, it is not surprising that there has been a resurgence of SPACs as well as a

marked growth in private equity activity in the tech sector. In the early 2000s, the number of PE

firms that were active in tech was tiny. Today there are hundreds. Sell-side bankers and VCs

have noted that the number of deals involving financial buyers has risen dramatically. The

universe of venture-backed companies is extremely large. Many of these companies have been

around for a while, with investors and employees who need liquidity. With the bar for a

traditional IPO as high as it is (and seemingly getting higher), there is a strong need for

alternative paths to liquidity.